Memorandum Of Transfer Fee

Memorandum of mortgage the buyer s mortgage is registered on the property s certificate of title.

Memorandum of transfer fee. Form cc 1660 w master 7 98 pc. On other hand stamp duty which also known as memorandum of transfer mot is payable to the government collected by lawyer on behalf of the government. Code 26 1 2 7 1 9 59. It s the legal equivalent of handing you the keys to the front door and saying the property is yours.

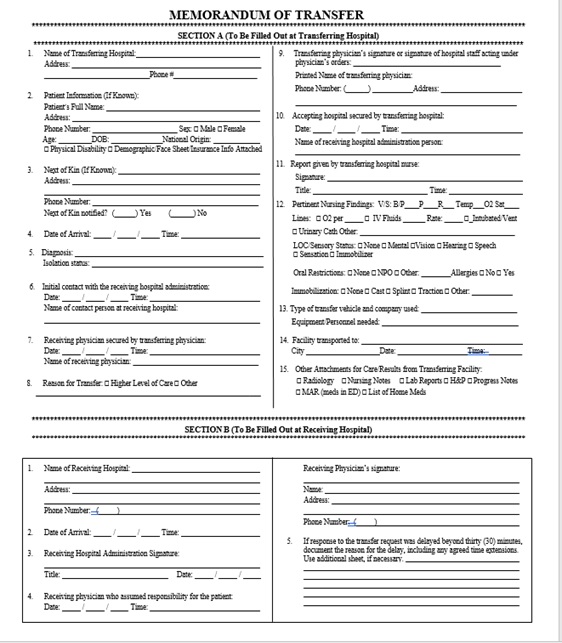

The existing lawyer is allowed to charge only 25 of the full scale fees subject to a minimum fee of rm200. So let s look at the stamp duty fees. Now is your chance to sign your memorandum of transfer or the less excitingly titled form 14a. State tax bond local tax certificate s of qualification qualification fee transfer fee record will order state library fee list of heirs copies total tax and fees collected date.

On other hand stamp duty which also known as memorandum of transfer mot is payable to the government collected by lawyer on behalf of the government. For example if the lawyer fee is rm5000 25 will be rm1250. The property stamp duty scale is as follows. The price paid for the property or its market value whichever is the higher.

The property stamp duty stands a considerable amount compare to other fees. Tax and fees collected. For property price exceeding rm7 5 million legal fees of the excess rm7 5 million is negotiable but subjected to maximum of 0 5. Legal fees is payable to the appointed lawyer who will prepare sale purchase agreement between purchaser and vendor.

You can always hire another law firm to handle the perfection of transfer pot perfection of charge poc. When a property is transferred assigned stamp duty is borne by the transferee assignee. Legal fees is payable to the appointed lawyer who will prepare sale purchase agreement between purchaser and vendor. Stamp duty is based on.

The calculation formula for legal fee stamp duty is fixed as they are governed by law. Spa loan agreement quotation includes legal fees amount disbursement fees 6 sst and stamp duty. It s the big one. Documents usually lodged along with the necessary fees with the land services sa after settlement include.

Both quotations will have slightly different in terms of calculation. Memorandum of transfer to transfer the certificate of title from the vendor s name into the buyer s. The mot is the document which legally confirms the actual transfer of ownership. Stamp duty for memorandum of transfer in malaysia mot malaysia can be extremely pricey and do check out the chart below for the tier rate.

The cost of a memorandum of transfer or property transfer is consists of the professional legal fee stamp duty disbursement fees and sale and service tax. The calculator will automatically calculate total legal or lawyer fees and stamp duty or memorandum of transfer mot.