Loan Agreement Stamp Duty Maharashtra

In a bid to boost the real estate sector maharashtra government has decided to cut the stamp duty charges while registering a property.

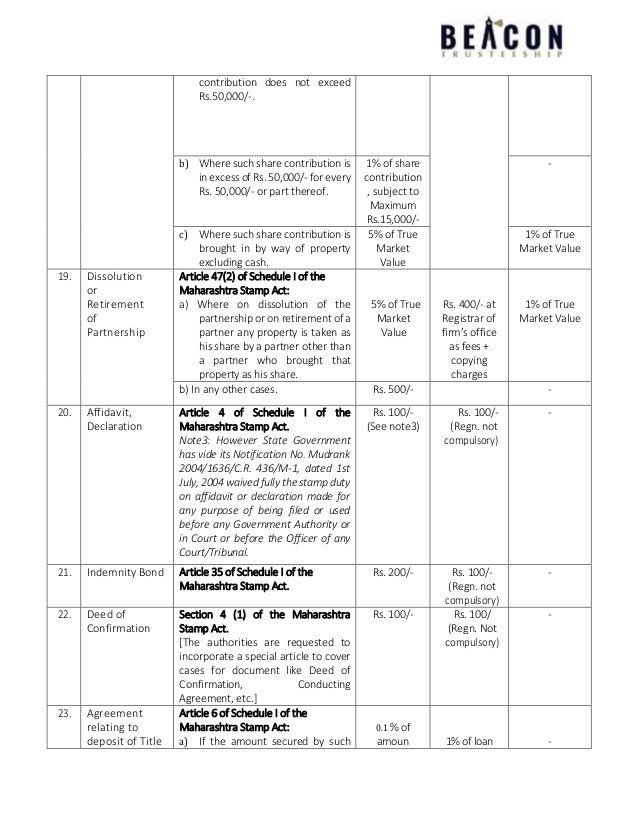

Loan agreement stamp duty maharashtra. Historically stamp duty on instruments pertaining to hypothecation pledge and equitable mortgage in the state of maharashtra was capped. As per a report in july 2020 the tamil nadu government is likely to reduce stamp duty and registration charges for all rental agreements of more than 12 months. Applicable stamp duty for state of maharashtra. The relaxation will continue with a 2 percent cut from 1 january to 31 march 2021.

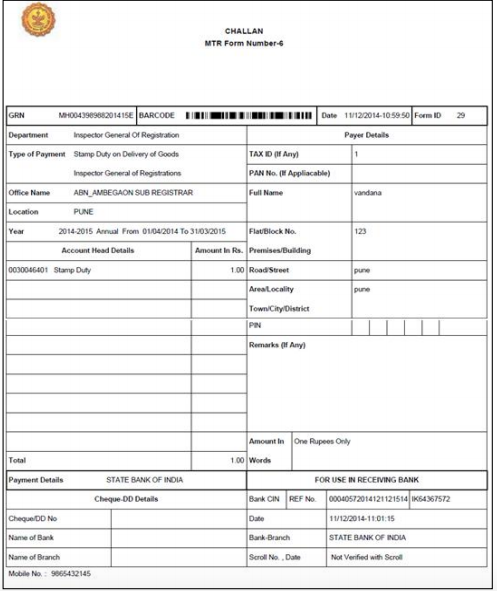

However stamp duty cannot be less than rupees one hundred. If the amount secured by the deed does not exceed rupees five lakh the stamp duty to be paid is 0 1 of the amount secured by such deed. The loan agreement is executed on 500 rs. Both can also be execute in one but to avoid ambiguity dual deeds executed.

Stamp duty in rs i if the loan amount secured does not exceed rupees ten lakh 0 1 of the amount agreed in the contract subject to minimum of rupees 100. The maharashtra government has decided to reduce stamp duty on all loan agreements to 0 1 per cent from 0 25 per cent it had prescribed earlier. 2 71. Article 6 of the bombay stamp act states the stamp duty on the equitable mortgage.

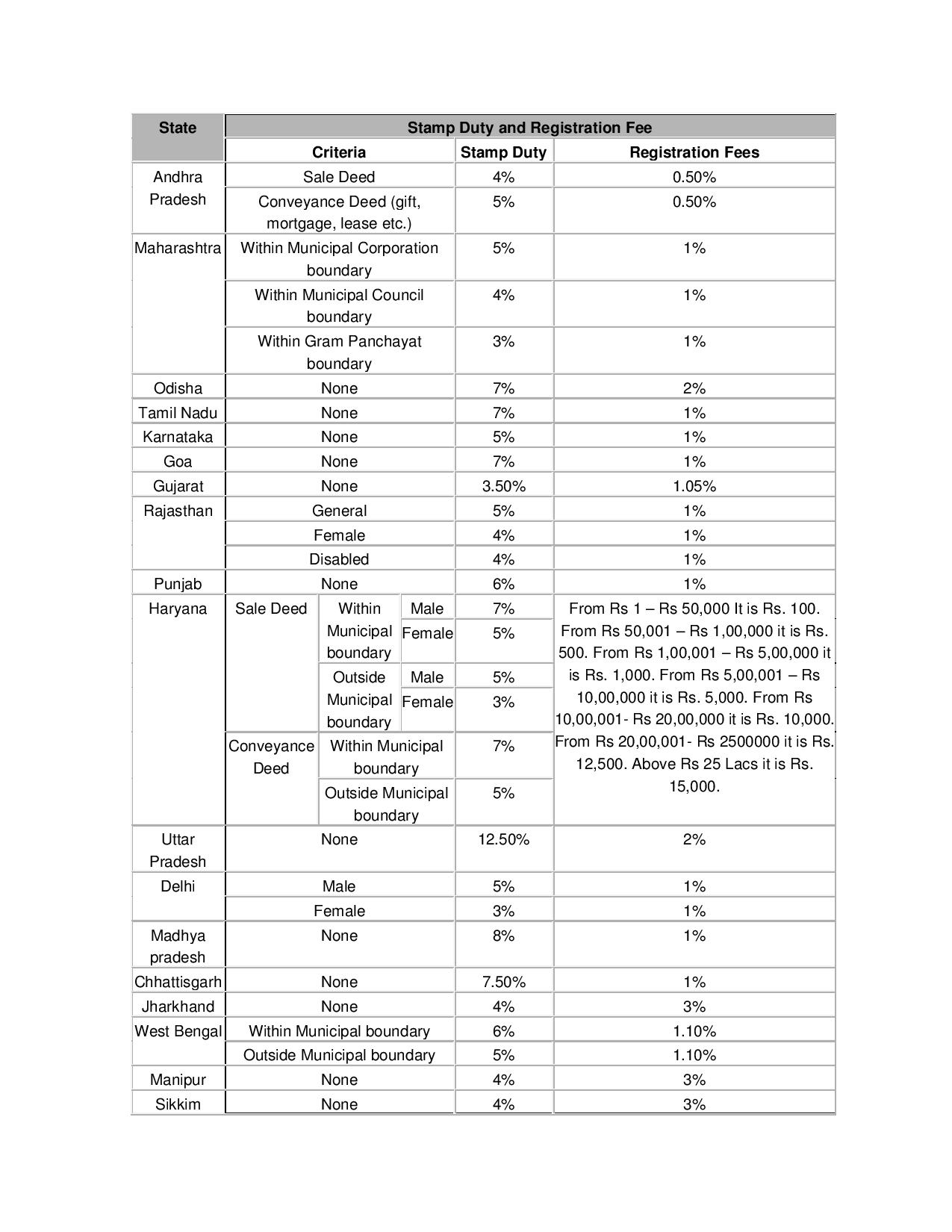

The stamp duty on sale deed documents has been reduced by 3 percent between 1 september and 31 december. Lx maharashtra stamp act 45 70 1 1 in determining the amount of duty payable or of the allowance to be made under this act any fraction of ten paise equal to or exceeding five paise shall be rounded off to the next ten paise and fractions of less than five paise shall be disregarded. However in july 2009 the government of maharashtra introduced an uncapped ad valorem duty of 0 2 of the amount secured. Stamp depends on state to state.

The decision follows representations from several quarters including indian banks association iba arguing that 0 25 stamp duty on loan agreement is exorbitant. Ii if the amount exceeds rupees ten lakh 0 2 of the amount agreed in the contract.