Epf Withdrawal For House Downpayment

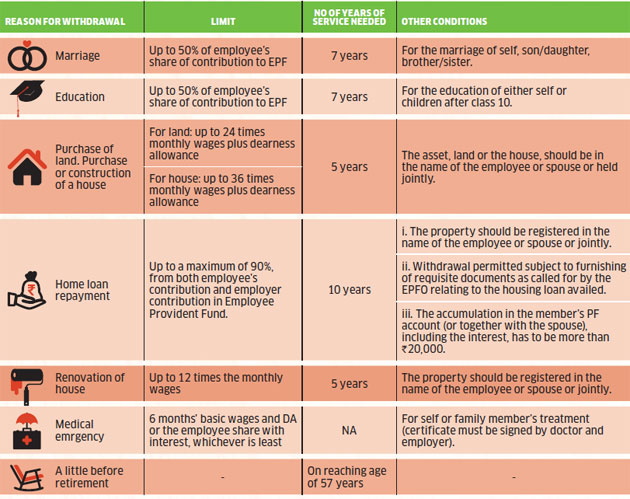

An employee can withdraw up to 90 of epf balance employee share and interest on that employer share and interest on that or the cost of the construction of property whichever is less.

Epf withdrawal for house downpayment. 1 withdrawals for investment homes you are allowed to withdraw and make your home purchase but not for the sake of investments. Withdrawals to facilitate epf members in preparing for a comfortable retirement the epf allows you to make a partial or full withdrawal from your savings to meet the specific retirement related needs that are in line with the epf s current policies. 2 withdrawals for second homes. Members bank accounts are still active and.

You can withdraw up to 90 of epf balance employee share and contribution of employer including interest or the construction cost of property whichever is less. The epf has a right to revoke your application if they find out that a transfer of ownership is taking place within less than one year. One can withdraw up to 90 of the balance to buy home subject to other conditions laid out by authorities. As per the existing rules for the purpose of purchase of a house from a promoter builder membership period required is minimum 5 years.

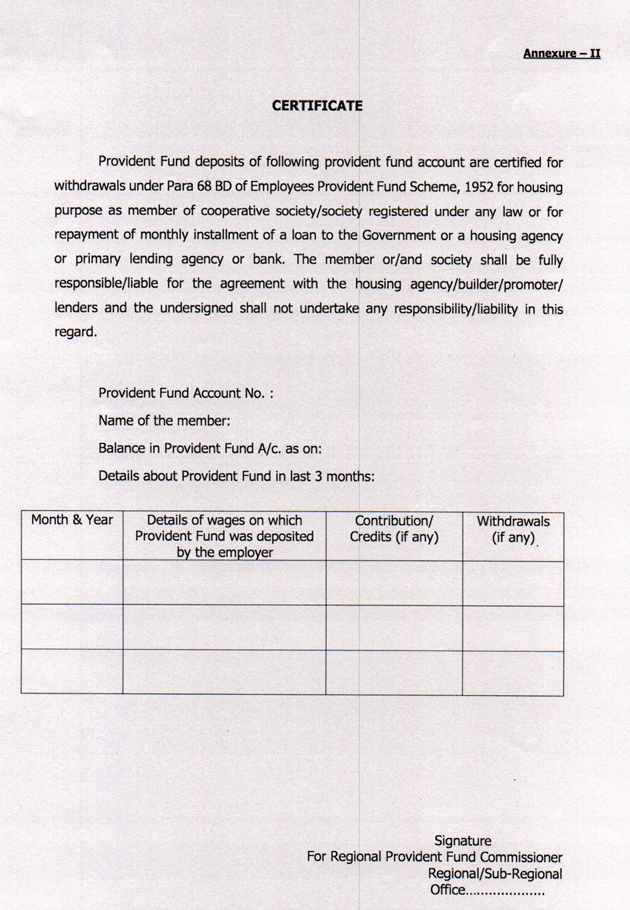

The withdrawal amount shall not be paid to you directly payment shall be made direct to cooperative society or housing agency or builder as the case may be. Some people may used this money as their renovation fund to beautify the house later. More can be read here. Withdrawal limits money from epf account 2 can be used to pay the price difference between the spa house price and the housing loan amount up to an additional 10 on the price of the house.

As per the pf scheme an employee can withdraw money from his her pf after 3 years of contribution to the purchase of a plot house flat. You may used the epf money to return money to your parent or sibling if you had borrowed from them for your 10 down payment initially. I would suggest to make good use of your epf money as it is your hard earn money. The payment for withdrawal will be credited directly to the bank account with the following conditions.

The maximum that one may withdraw from the pf account is 36 month s basic wages or the total of employee and employer share with interest or total cost whichever is least.